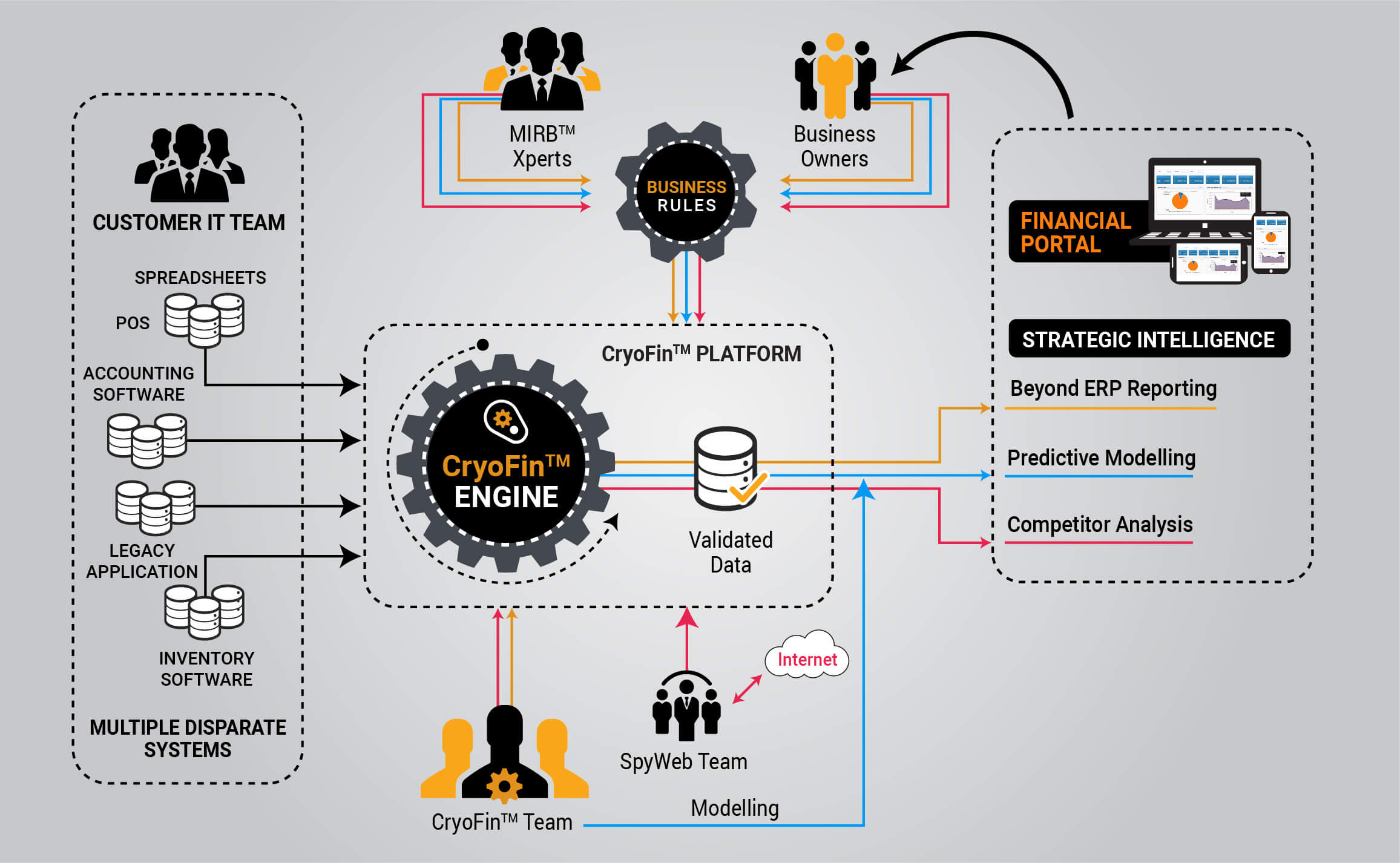

Most mid-sized enterprises may have excellent but disparate IT systems and applications that work in silos. These IT systems and applications may also provide comprehensive reports at a functional level. However, Business Owners need insights that are beyond the traditional system generated reports.

To mitigate the risk of business decisions, they need cross-system insights that are updated in real-time. For this, they need to collate numerous historical reports and merge them on spreadsheets, which consume time and are prone to errors. Skills needed to compile, authenticate and process such data from multiple systems are scarce.

CryoFin™

CryoFin™ platform uses the most sought-after technology in the analytics space to connect with all disparate systems. It aggregates, validates and normalizes data and provides unified, cross-functional reports in real-time by applying business rules as defined by MIRB™ Xperts.

Quick Integration

- CryoFin™ can be easily integrated with any type of Business Unit, irrespective of industry, geography, size or age

Overcome Legacy Issues

- CryoFin™ can talk to any legacy system, of any vintage

- No need to spend money on costly software upgrades

- Savings unlock alternate investment opportunities

Maximize Benefits

- CryoFin™ helps businesses derive maximum benefit from their investments in capital, personnel, infrastructure and business processes through predictive, descriptive, diagnostic and drill-down analysis.

MIRB™

MIRB™ is a proven thought process that has matured over a decade. It consistently evaluates business by focusing on four aspects that are critical for success of any enterprise – Money, Infrastructure, Resources and Business.

MIRB™ Xperts, comprising CAs, CPAs and MBA (Finance) professionals – all trained and certified in MIRB™ way of thinking – work with the Business Owners to define Beyond-ERP reports that provide cross-system analytical reports and business insights. They also create sophisticated mathematical/predictive models that help Business Owners to analyze various business scenarios and assess the impact of their decisions.

SpyWeb

The SpyWeb team works with the MIRB™ Xperts to provide Competitor Analysis to Business Owners by crawling the internet, which helps them devise business strategies with deep market understanding.

Comprehensive Reports

The standard set of reports, each defined to provide insight into a specific aspect of the business, is available in the FinFacets Portal. When considered together, these cross-functional and granular reports paint a complete picture of the enterprise in vivid detail and provide insights to the Business Owners to make better, sharper and faster decisions.

Capital/ Fund Management

- Working Capital Investment Analysis/ Management

- Receivables Management

- Payables Management

- Suspected Bad Debt Reporting

- Projected Cash flow & Working Capital Requirement Analysis

- Capital Structure Analysis- Adequate Debt and Equity Structure

Treasury

- Forex P & L

- Efficient Investment of free short-term liquidity

- Liquidity and Funds Management

- Ensuring appropriate ROI

- % of “Business on Hand” hedged for Forex Risk Management

- Average Exchange Rate, Duration, Amount Hedged

Taxation

- Efficient Tax Planning

- Cross-Border Transactions for Global Operations

- Restructuring Business Transactions

- Periodic Taxation

- Compliance Tracker

- Avoidance of Tax Leakages and Double Taxation

Capacity Utilization

- Seating Capacity Utilization

- Proactive Planning for Business Growth

- Best Usage of available resources

- Fixed Assets Management- Location-wise, User-wise, Business Unit-wise etc.

- Marginal Cost Approach- Alternative Usage of Free Capacity

Risk Management

- Insurance Audit

- Assets Maintenance and its Security Plan

- IT Environment Security

- Back up Plan and Data Security

Administration

- Logistics and Supply Chain Analysis

- Vendor Management

- Purchase and Stores Management

- Utility Management + Cost Rationalization

- Inventory Management/COGS

Productivity

- Revenue vs. Employee Allocation

- Capacity Utilization Report

- Billing Efficiency

- Pyramid Structure Analysis

- Average Cost Salary Report

- urnaround Time Report

- Employee-wise profitability / efficiency / billability

- RPRJ- Right Person allocated for Right Job

HRM

- Time Management & Disciplinary Parameters

- Succession Planning for Key Personnel & Job Rotation

- Pre Defined KPIs / KRAs and 360 Degree Evaluation

- Career Road Mapping - Job Enrichment Programs

- Employee Attrition Reduction and Retention Planning

- Reward and Recognition Mechanism

- Employee Engagement Events

- Grievance Management & Analysis

Training & Development

- PIP Implementation - Performance Improvement Plan (Quadrant Approach)

- Attitude / Communication/Inter Personal Skills Development for Q2 & Q 4 Employees

- Technical / Domain Knowledge Up gradation for Q3 & Q 4 Employees

Recruitment

- Planned Recruitment - in Line with Business needs (Proactive Recruitment Approach)

- RPRJ- Right Person recruited for Right Job

Performance Evaluation

- Business Unit-wise Profitability

- Business Forecasting

- Project life cycle analysis

- Project / Client / Geography / Resource-wise Profitability

- Project Efficiency / Overrun

- Migration / upgradation with Changing Business Scenario

- Trend based Analysis & Historical Comparison

- Benchmark setting and its reporting with Actuals with Qualitative Reasoning

- SWOT Analysis

- Simulation and Optimization

Sales

- Market Positioning Analysis

- Lead Generation Analysis

- Sales Budget Formation

- Competitive Analysis

- Client Eco System Analysis

- Internal and External Branding

- Client Retention Analysis

- Campaigns and Database Management

- Billing rate / Pricing analysis

- Size of Engagement and Quality of Customer Analysis

- Sales - Periodic Target vs. Achievement Analysis with corrective actions

Legal & Risk Mgmt.

- Contract Management - Centralized Legal Documents Vetting Process

- Insurance Coverage for Business / Commercial Liability

- Periodic Statutory Compliance Tracker (Calendar) - to Ensure Timely Compliance

Costing

- Cost Trend Analysis

- Budget Formation - Cost Centre

- Cost Centre-wise Variance Report with Reasoning

- Variable Cost Optimisation Analysis

- Opportunity Cost Analysis

Financial Portal

The combination of CryoFin™, MIRB™ and SpyWeb results in a cutting-edge, extremely potent and effective approach for Business Owners to take decisions based on deep insights across all parameters of their business.

FinFacets provides Business Owners a dedicated Portal with Strategic Intelligence.

Actioning Team

One of the unique features of FinFacets’ offerings is its Actioning Team that works with Business Owners in their pursuit of achieving the organization’s goals. It comprises CryoFin Xperts, MIRB™ Xperts and SpyWeb Xperts.

The Actioning Team develops all strategic and tactical intelligence reports required by the Business Owners and gets them populated in the FinFacets Portal.